From Friday 1st January 2021, the requirement for accurate customs documentation for items containing goods or gifts when shipping internationally also started to apply to EU destinations. The changes are required by the Universal Postal Union (UPU) and the World Customs Organisation (WCO).

There are three types of customs forms: CN22 (A and B), CN23, and commercial invoice. These customs documents are now mandatory for all gifts and goods sent to a country outside the UK, except when sending items from Northern Ireland to the EU.

When you ship items internationally, you must ensure those items abide by the shipping rules of the destination country. Customs forms allow local customs authorities to make sure the goods are allowed and calculate any duties or taxes to be paid.

This article will focus on what the CN22A, CN22B, and CN23 forms are, the necessary information you will need for completing these forms, and will help you understand which one you should use for your international orders.

What is the difference between CN forms and commercial invoice?

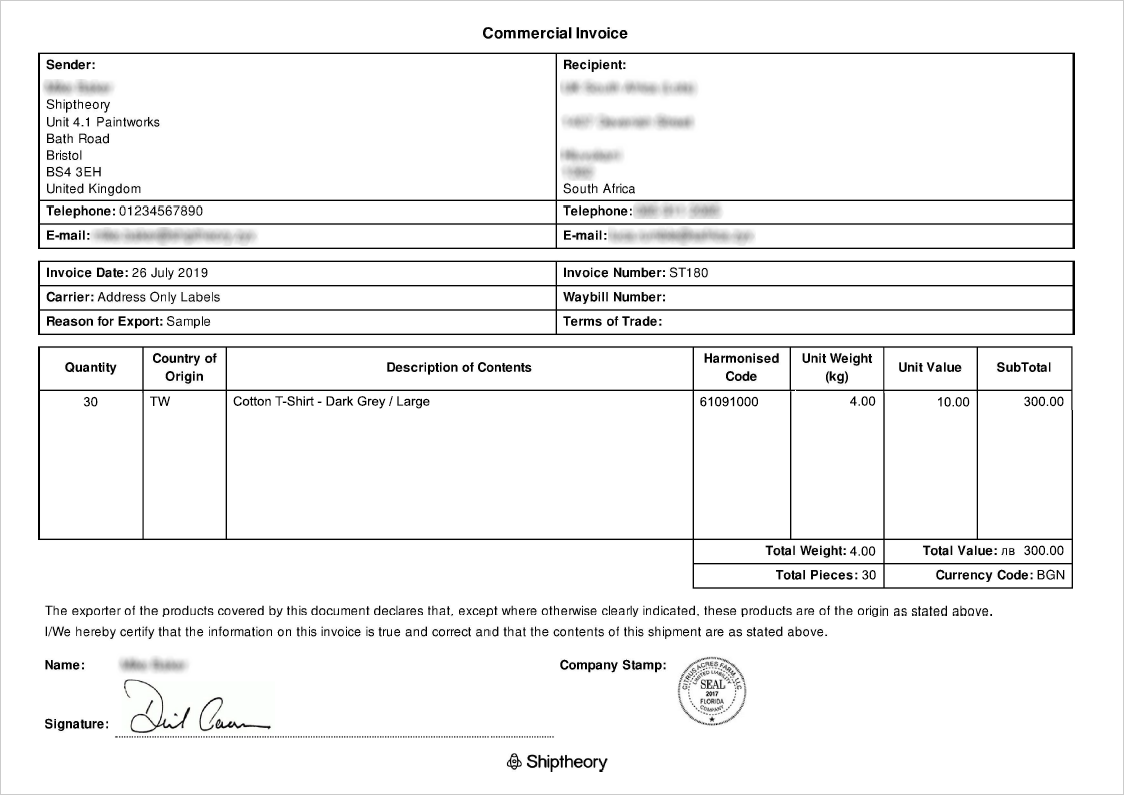

The CN22 and CN23 forms are used by the Universal Postal Union and are therefore mandatory for postal services. A commercial invoice is also a customs form that you need to include in all international commercial shipments. It contains information about the contents of the package and the agreements made as to who pays the customs costs (Incoterms). The customs authorities determine whether import duties have to be paid on the goods based on the commercial invoice.

If you send a package using a postal service like Royal Mail, you need to use a CN22 or CN23 customs form and a commercial invoice.

If you are using a carrier such as FedEx, DHL, or DPD instead of a postal service, you do not need to add a CN22 or CN23 form.

Nevertheless, to avoid delays, we recommend that you always include both documents in your parcels.

Form sizes

Commercial Invoices: A4

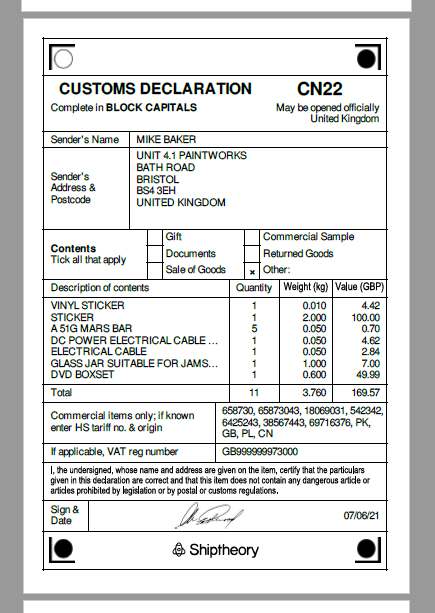

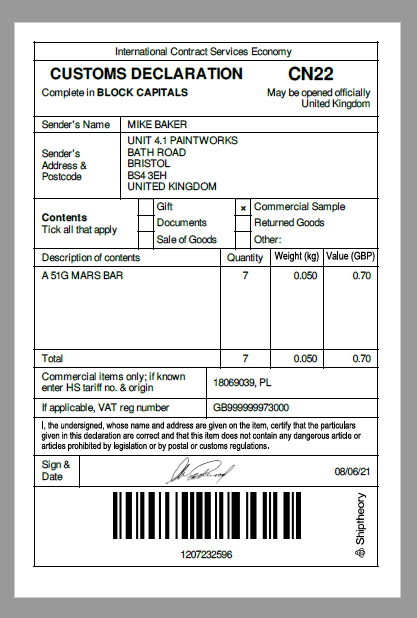

CN22 forms: 4" x 6"

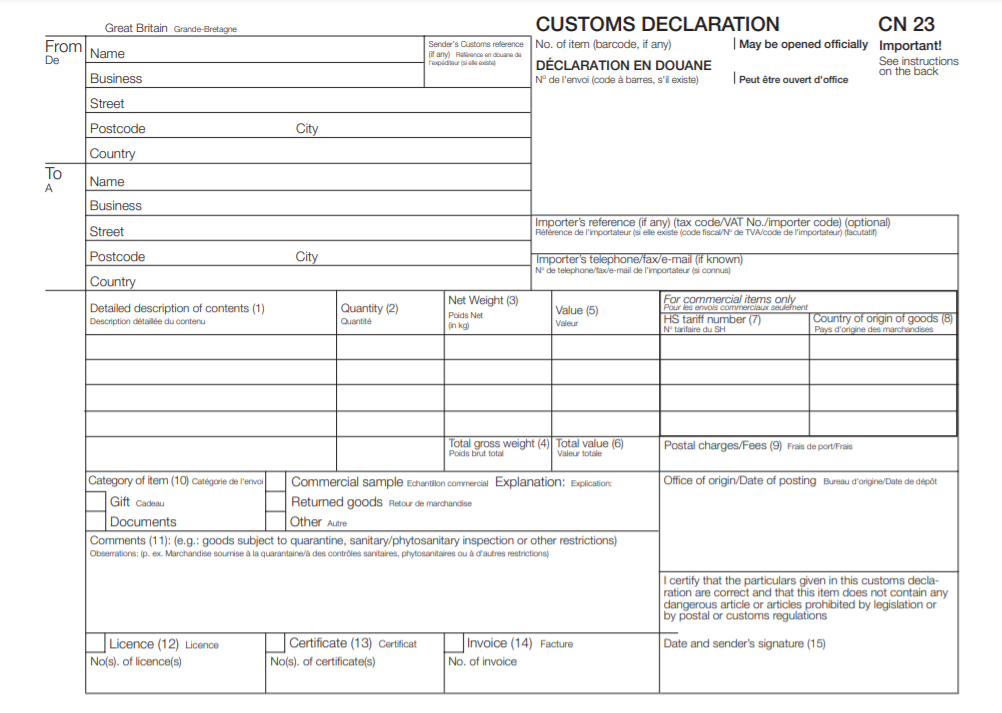

CN23 forms: A5

CN22A and CN22B forms

The CN22 is a customs form used when sending gifts and goods internationally worth less than £270 with Royal Mail. They are mandatory for all gifts and goods being sent internationally from England, Scotland, or Wales. If you are shipping from Northern Ireland, they are only needed for posting to non-EU destinations.

If you are sending items with Royal Mail International Tracking and Signature services, you'll need a CN22A form.

If you are shipping your items with Royal Mail International Economy or International Standard services, you'll need a CN22B form that includes a barcode unique to your shipment.

CN23 form

The CN23 is a customs form used when sending gifts and goods abroad worth more than £270 with Royal Mail. It contains more details than the CN22 forms, like licence and certificate numbers and information on whereas the products are subject to quarantine, sanitary or phytosanitary inspections.

Information you will need for completing your CN22 and CN23 customs forms

It is essential to complete all mandatory fields on your customs forms. If you don't complete the fields below, your item will likely be returned or delayed. The required fields are the following:

1. Sender's name and address

2. Type of Contents and accurate content description

3. Value, quantity, and weight of each item

4. Total value, quantity, and weight

5. HS tariff number (you can find these here)

6. Country of origin

7. GB EORI number or VAT registered number

8. Sender's signature

9. Recipient's name and address (for CN23 form only)

Customs forms need to be attached to the outside of your parcel with all relevant fields completed. The forms are scanned by optical character recognition, so it is essential to fill them legibly and in BLOCK CAPITALS. Any parcels with incomplete or absent customs forms are likely to be delayed, returned, or paying more tax, so it's of utmost importance that you get it right.

Automate your customs forms with Shiptheory

You can fill in your customs forms manually, and that might be a viable option if you have just started your e-commerce business and only need to ship a couple of international orders every month. But as your business evolves and your order volume grows, typing customs forms manually can be extremely time-consuming. Moreover, it would be exceedingly difficult to avoid data-entry errors resulting in a waste of money and time and, most importantly, customer dissatisfaction.

Shiptheory can automatically generate, auto-fill, and print customs documentation required to export shipments around the world at the same time as generating your shipment's shipping labels. This includes CN22A, CN22B, CN23, Commercial Invoices and Electronic Paperless Trade Documents (where the respective carrier and country supports it).

Shiptheory also offers a handy commodity data checking tool that automatically identifies and highlights any issues or omissions in your product data and helps you to significantly reduce the chance of your shipments being delayed, returned, or paying more tax.

For a complete guide on how to enable the new CN22A and CN22B customs forms on your Shiptheory account read here.

If you have any queries regarding the above customs forms, please do not hesitate to reach out to support. Our shipping specialists are more than happy to answer your questions and help you with your international shipping.

Otherwise, create a free Shiptheory account, generate your customs forms and shipping labels automatically, and start shipping smarter and faster today!