Convenience and security are your customers’ primary concerns when they reach your online shop’s payment gateway page and the lack of them, two of the top reasons for online cart abandonment during checkout. In today’s highly competitive e-commerce world, providing multiple, flexible, and effortless payment options will put you at a significant advantage against your competition and fortify your brand loyalty. Strengthening the relations with your customers is something of great importance nowadays, since the pandemic has, among others, caused a one-in-a-lifetime shock to brand loyalty.

There are several things to consider when choosing the best payment options for your e-commerce shop. Comparing set-up and transaction fees between providers is the most obvious thing to start with. Nevertheless, you also need to take into consideration what types of payment methods each payment solution supports, their encryption methods and security procedures, as well as their fraud protection and chargeback policies. Last but not least, choosing the most suitable payment solutions for your online store depends heavily on the type of your business and your target market.

Choosing the right payment solutions when there are so many available nowadays can be an overwhelming task. To ease your struggle, we provide you with a comprehensive guide to the best payment solutions for an international e-commerce website.

PayPal

PayPal is one of the most familiar online payment options, with 286 million active users and a company with an excellent reputation when it comes to ease of use, reliability, and security. With PayPal Checkout, you can accept debit and credit cards, payment through a PayPal account, and more than ten local payment methods in over 100 currencies from 200+ markets around the world.

PayPal Checkout integration ranges from simple to completely customisable. The Quick Setup option can be implemented in minutes by merely copying pre-built code and pasting it next to the products or services you want to sell on your website. It includes basic customisations like changing alignment, shape, and colours. If your e-commerce business requires fully custom credit and debit card field design and alternative payment methods available, you should aim for the Advanced Integration option which also offers fraud-protection tools to set up your own risk tolerance filters.

With PayPal, any e-commerce sale in the UK costs 2,9% plus 30p per transaction. International sales are a bit more expensive, with 3.4% per transaction, plus a fixed fee depending on currency received.

Amazon Pay

Amazon Pay is an online payments processing service, owned by Amazon, that lets you use the payment methods already associated with your Amazon account to make payments for goods or services on third-party websites. With more than 197 million active monthly users, it is most likely that a large number of your customers have an Amazon account already. If you want to include Amazon Pay to your payment options, you need to register for a new Amazon Payments merchant account, even if you already have another Amazon seller account.

The Fee Schedule for Amazon Payments accounts in the UK is 2.7% plus 30p for each transaction. Depending on the nature of the transaction, additional fees may apply like a cross border fee if you receive a payment from a payment method issued outside of the UK and a currency conversion fee for every transaction that requires a currency conversion

Google Pay

A digital wallet, also known as e-wallet, is an electronic device, online service, or software program that stores a user’s payment details and allows them to make safer cashless purchases online and in-store. As well as storing your payment details for online payment systems, digital wallets can also connect with traditional bank accounts and act as a digital version of your credit or debit card. One of the most popular digital wallets is offered by one of the most recognisable companies in the world: Google.

Google Pay is a digital wallet platform and online payment system developed by Google to enable in-app and tap-to-pay purchases with Android phones, tablets, and watches. It is free of charge for your business and your customers, and its encryption and card tokenisation helps reduce merchant risk and exposure to fraud. Since hundreds of millions of users already have their paying information stored into their Google accounts, adding Google Pay as a payment option to your e-commerce store can be proved very convenient for a large number of your customers.

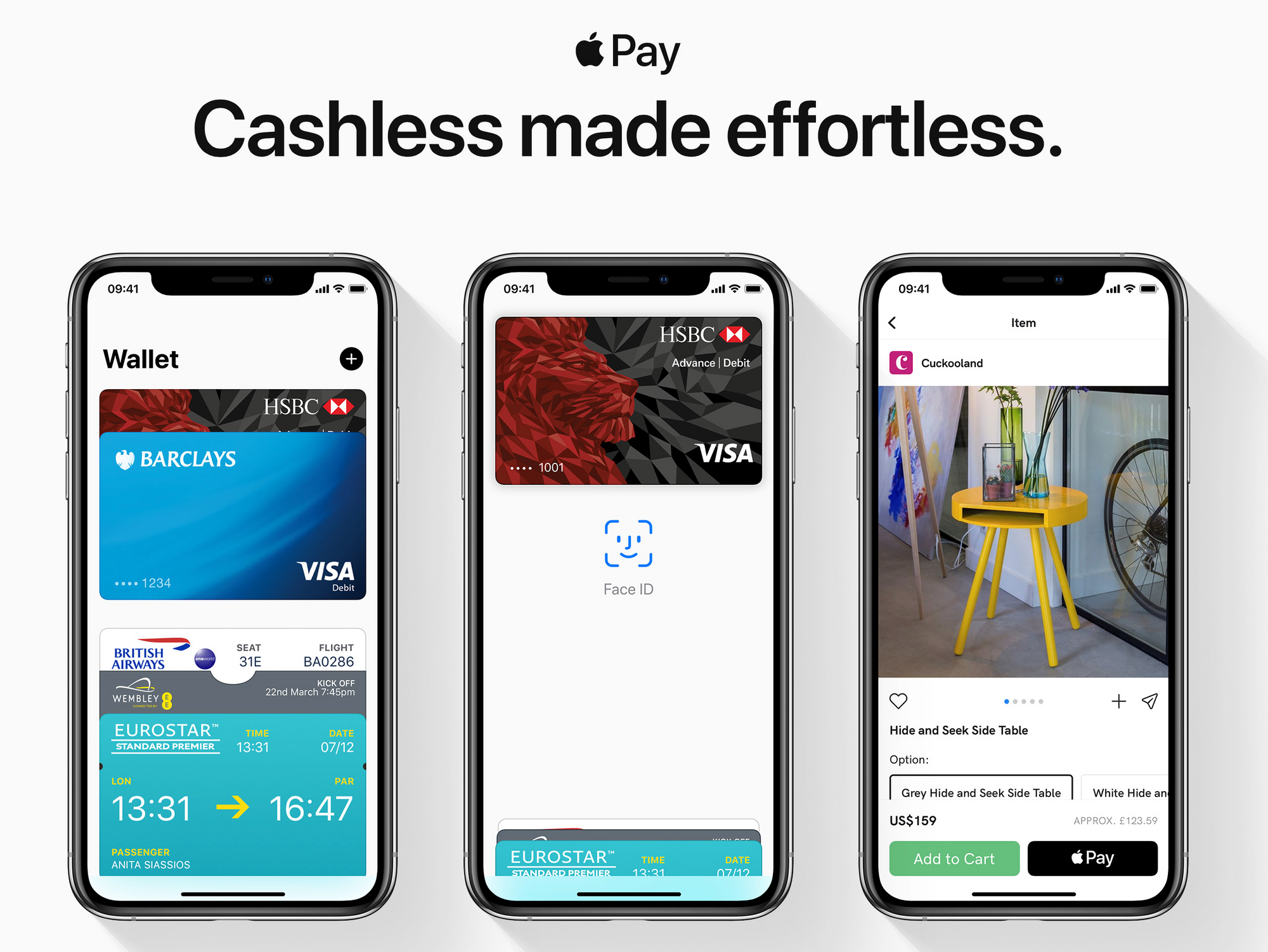

Apple Pay

Apple Pay is a mobile payment and digital wallet service by Apple that allows users to make payments in person, in iOS apps, and online. However, Apple Pay web support is limited to the Safari browser only. It is supported on the iPhone, Apple Watch, iPad, and Mac computers. Apple Pay works with Face ID or Touch ID to deliver two-factor authentication. That means your customers do not need to verify payments through passwords, secret questions, etc.

When a customer makes a purchase from your online shop, Apple Pay uses a device-specific number and unique transaction code. That way, card details are never stored on their device or Apple servers. Like Google Pay, Apple Pay is free of charge for you and your customers. You can easily set up your e-commerce website to accept Apple Pay by utilising their API, although you need to use one of the compatible platforms or payment providers.

Square

Square is generally associated with its POS systems for in-store payments. Nevertheless, the company also offers e-commerce options. Square Online Checkout, an online payment API, lets you create a pay link in just a few steps. Customers click through and get taken to a simple checkout screen where they asked to enter their name, email, and payment details.

The platform accepts all major credit and debit cards, Apple Pay, and Google Pay. Square charges 2.5% per transaction without contracts, monthly fees, or start-up costs and integrates with various e-commerce platforms and CRM tools.

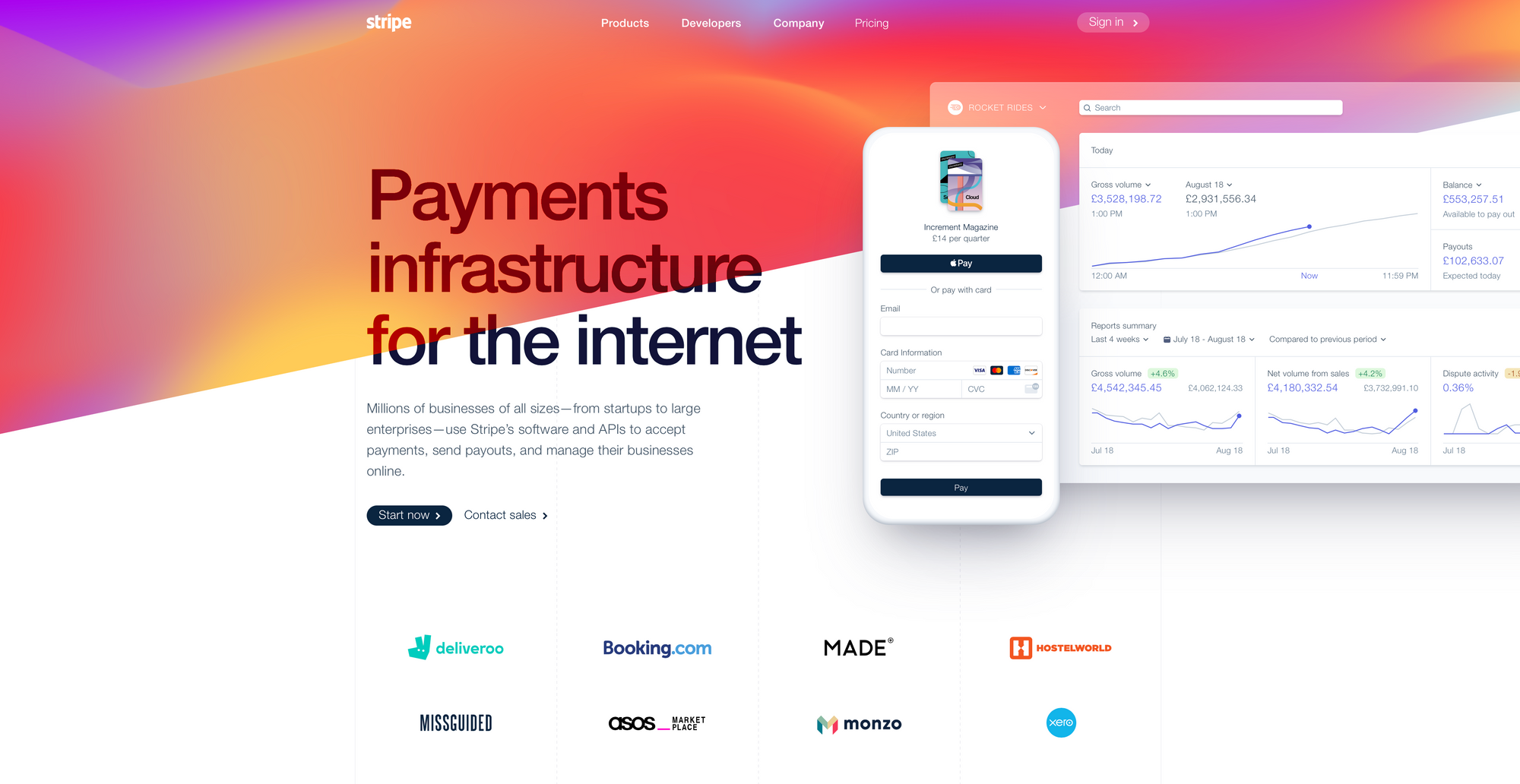

Stripe

Stripe is one of the most versatile payment methods on the market today. Its powerful API’s and software solutions let your international customers pay with their preferred payment method by supporting more than 135 currencies, all major debit and credit cards, ACH transfers, Apple Pay, Google Pay, and more. Another great feature of Stripe is that it offers a recurring payments option and the ability to manage subscriptions.

Beside online payment, Stripe supports in-store transactions as well. Stripe Terminal extends your online presence into the physical world, enabling you to build your in-person checkout and helps your brand unify its online and offline channels with flexible developer tools, pre-certified card readers, and cloud-based hardware management.

The platform offers AES encryption, is certified to the highest industry standards, and has obtained regulatory licenses around the world. Using Stripe, the cost per transaction is 1.4% plus 20p for European cards and 2.9% plus 20p for non-European cards. If currency conversion is required, an additional 2% fee will apply.

Buy now, pay later options: Klarna and Pay in 4

Buy now, pay later (BNPL) schemes are a form of point of sale credit that allows customers to pay for purchases over time after receiving the goods; the most popular among them being Klarna. With Klarna you get paid upfront for every transaction, while your customers get the option to pay later. They can split the cost of their purchase into three interest-free monthly instalments, pay in full up to 30 days later, or spread the cost in up to 36 monthly payments with the company’s ‘Financing’ plan.

You can use Klarna Checkout through most of the major e-commerce platforms, or it can be integrated directly into your e-commerce website. The service is integrated in such a way that Klarna can make automatic updates to it, and it will cost your business 2.49% plus 20p per transaction.

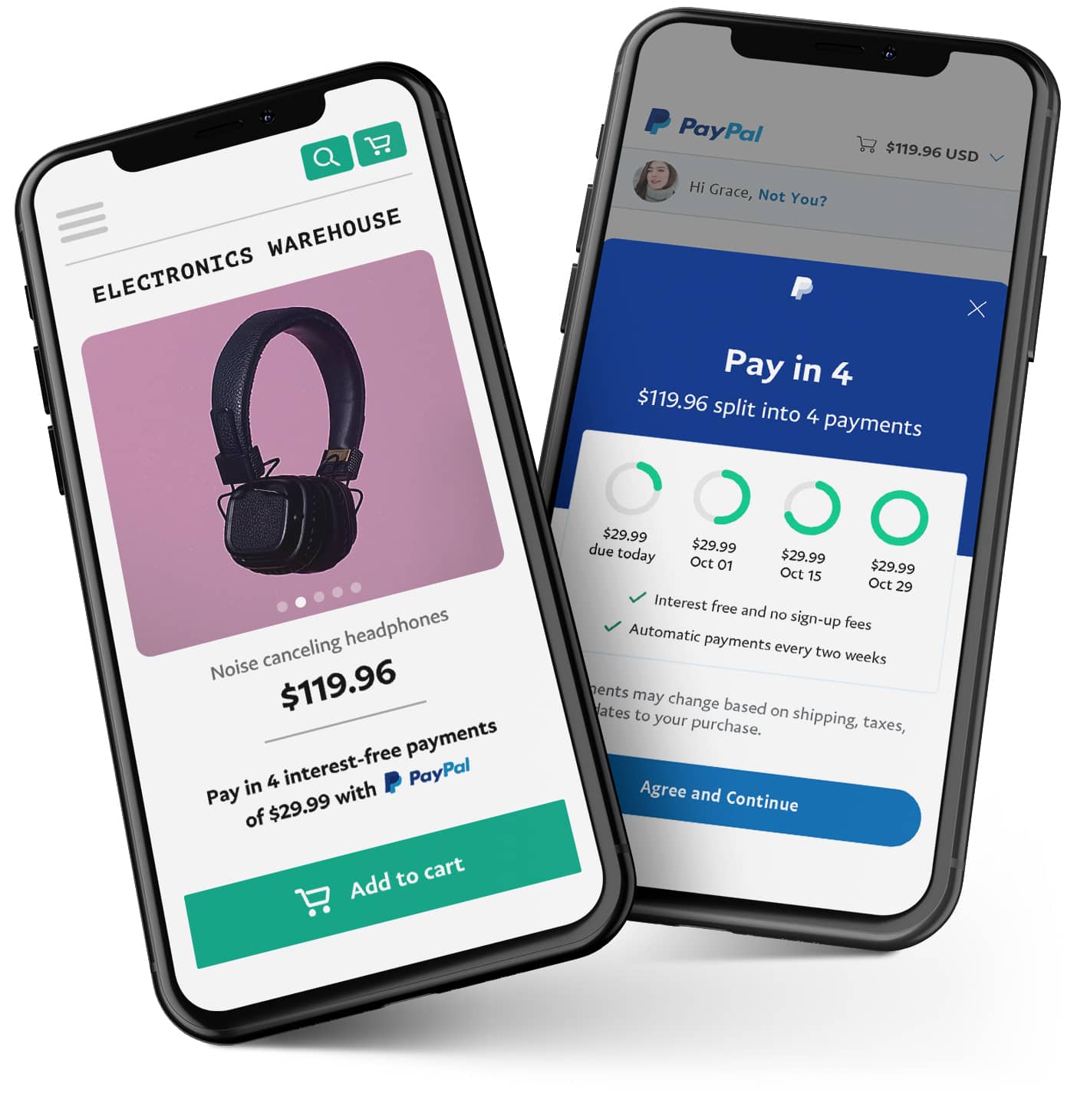

At the end of last month, PayPal introduced its own BNPL option for the US market called ‘Pay in 4’ that enables merchants and partners to get paid upfront while allowing customers to pay for purchases between $30 and $600 over a six-week period with no interest charges or other fees.

Conclusion

As demonstrated above, there are various payment solutions to choose from for your e-commerce site and selecting the right ones is essential for the e-commerce success of your business. Each one of them, like everything in this world, comes with its pros and cons.

But in the end, it’s not a question of which is the best one; it’s more a matter of how many different payment options you will make available to your customers. Analyse your business niche, as well as your target market, and also investigate what payment methods your competitors are offering. Then you will have enough information to help you choose the correct payment methods for your e-commerce site that best respond to your customers’ needs and preferences.

Payment should be a seamless process at the end of the customer journey so you must try to make it as convenient and straightforward as possible for them.

No matter what payment methods you choose to include into your e-commerce site, using a shipping management platform like Shiptheory that allows access to the world’s best carriers, can offer you the best shipping solutions for your e-commerce business, saving you money and time.